We are a team of technology experts who are passionate about what we do. We LOVE our customers. We LOVE technology. We LOVE helping you grow your business with technology.

- Services

-

Al and Machine Learning

-

Artificial Intelligence Services

-

Machine Learning Services

-

Generative Al Services

-

Robotic Process Automation

-

Natural Language Processing

-

Chatbot Development Services

-

Enterprise AI Services

-

Data Annotation Services

-

MLOps Services

-

IoT Services

-

Data Mining Services

-

Computer Vision Services

-

LLM Development Services

-

-

Agents

-

AI Agents

-

Agentic AI Development

-

-

Software Development

-

Custom Software Development

-

Enterprise Software Solutions

-

Software Development Services

-

Website Development Services

-

Software Product Development Services

-

SaaS Development Services

-

-

Mobile App Development

-

Mobile App Development Services

-

Custom Mobile App Development

-

IOS App Development

-

Android App Development

-

Enterprise Mobile App Development

-

Hybrid App Development

-

-

Outsourcing

-

Software Development Outsourcing

-

Dedicated Development Team

-

Staff Augmentation Services

-

IT Outsourcing Services

-

-

BI and Data Analytics

-

Data Analytics Services

-

Data Analytics Consulting Services

-

Business Intelligence Solutions

-

-

Software Modernization

-

Software Modernization

-

Application Modernization Services

-

Legacy System Modernization

-

-

Cyber Security

-

IT Security Solutions

-

Cyber Security Solutions

-

Cyber Security Managed Services

-

HIPAA Compliance Cyber Security

-

-

Cloud Computing

-

Cloud Application Development

-

Custom Web Application Development

-

Cloud Consulting Services

-

AWS Cloud Consulting Services

-

Enterprise Cloud Computing

-

Azure Cloud Migration Services

-

- Solutions

-

AI 10X Accelerator

-

ConstructionAI

- Industries

-

Construction

-

Health Care

-

Financial

-

Real Estate

-

Manufacturing

-

Retail

-

Automotive

-

All Industries

- Pricing

- Company

-

About Us

-

Our Team

-

Testimonials

-

Awards and Recognitions

-

Careers

- Resources

-

Blog

-

eBooks

-

Case Studies

Modernize Your Workflow with Our Custom Insurance Software Development Services

-

Enhance Policyholder Experience with Smart Digital Solutions

-

Effortlessly Automate Claims, Underwriting & Policy Management

-

Protect Critical Data with Robust Compliance & Security Measures

-

Drive Operational Excellence with Modern Insurance Technology

We are a Reliable Healthcare Software Development Service Provider Partnered with Fortune 500 Companies, SMBs, and Startups

Trusted by

Industry Leaders

Industry Leaders

Our Insurance Software Development Services

At Tech.us we build future-ready insurance software solutions which elevate your processes at every touchpoint. We combine deep domain expertise with sophisticated engineering as our team ensures your insurance business stays resilient in a competitive market.

Custom Insurance Application Development

Build agile and scalable platforms specific to your unique business model so that every function runs with sharper precision. We follow robust engineering approach which supports continuous enhancements with stronger flexibility and faster time to market.

Claims Management Software Solutions

Transform your entire claims continuum into a frictionless experience from FNOL to assessment verification approval and payout. Our intelligent routing helps reduce delays as it automates workflows and prevents human errors.

Underwriting Automation and Decision Support

Equip underwriters with advanced intelligence which helps them evaluate risks accurately at digital speed. We design AI-driven rules engines with automated data validation which reduces manual interventions as well as ensures operations remain consistent and strong.

Policy Administration System Modernization

Adopt a dynamic digital system which supports every policy event throughout its lifecycle as we enable features from real-time access to policy information to smoother endorsements and effortless renewals. We offer elevated experience for customers and partners.

Insurance Data Management and Analytics

Connect siloed systems into a unified data ecosystem which fuels confident decisions and strategic growth as our solutions improve data lineage security and accessibility. With this, you can run predictive models and accurately identify fraud patterns and forecast revenue.

Customer and Agent Portal Development

Create a powerful digital gateway which gives policyholders and agents the freedom to act instantly without waiting for back-office support. Our personalized insurance solutions improve customer satisfaction, retention, cross-sell potential, and overall brand credibility.

Why Choose Tech.us for Your Insurance Software Development

As a trusted insurance software development company, Tech.us builds technology which ensures intelligent and smooth operation across your domain. With deep domain expertise, we build solutions that resonate with your business.

25+ Years of Expertise

We understand insurance challenges across underwriting claims and compliance from real project experience. Our team leverages this and delivers measurable transformation backed by strong domain insight.

Agile Delivery

We deliver progress in continuous increments as we ensure collaboration without any disruption to ongoing operations. Our swifter releases ensure quicker value realization for your teams and customers.

Flexible Teams

Our flexibility is our biggest advantage. With seasoned experts across a variety of skillsets, we help your business evolve significantly. Our experienced engineering teams support both innovation and stable long-term operations.

Higher ROI

We focus on solutions which reduce expenses and increase efficiency all the while strengthening profitability. Our technology investments turn into long-term competitive advantages not overhead.

1500+

PROJECTS

DELIVERED

25+

YEARS IN

BUSINESS

30+

INDUSTRIES

SERVED

5

CONTINENTS

SERVED

100%

COMMITMENT TO

YOUR SUCCESS

The Innovative Insurance Software Solutions We Offer

We help insurers future-proof their operations with modern systems as we design to boost accuracy, speed and trust at every stage of the insurance lifecycle.

Claims Management Platforms

Create a smooth claims journey with faster approvals and transparent customer communication. Reduce errors and manual work through guided workflows. Strengthen trust with quicker fair outcomes.

Underwriting Decision Systems

Speed up policy decisions with smarter risk evaluation support. Reduce manual checks and keep every assessment accurate. Help underwriters focus on complex scenarios instead of repetitive tasks.

Policy Administration Solutions

Manage policy creation updates renewals and servicing in one place. Give teams clear access to real-time information. Deliver a better experience for agents and policyholders without delays.

Customer Self-Service Portals

Allow customers to manage policies, file claims and get answers instantly without support wait times. Lower operational load for your teams. Improve engagement and retention through convenience.

Agent and Broker Portals

Help agents work more efficiently with faster onboarding instant policy lookups and quick quote support. Remove paperwork complexities. Strengthen agent relationships and distribution performance.

Billing and Premium Management Systems

Streamline premium payments account updates and invoicing. Avoid delays and confusion with full payment visibility. Improve revenue accuracy and customer satisfaction.

Risk Management Platforms

Use unified insights to understand potential exposure early. Make stronger decisions that protect margins. Keep your business resilient as risk patterns shift.

Fraud Detection and Prevention Systems

Spot suspicious activities with instant alerts that prevent losses. Improve claim authenticity checks without slowing operations. Keep customers secure and brand reputation strong.

Personalized Insurance Solutions

Offer flexible policies and pricing tailored to customer needs. Improve conversions with relevant product experiences. Build long-term loyalty through proactive engagement.

Workflow and Back-Office Automation

Remove repetitive tasks across departments and speed up everyday operations. Minimize errors and handoff delays. Let teams concentrate on high-value work that drives business outcomes.

Tech Stack

We use a broad and proven technology stack which adapts to your business needs and future goals.

AI / ML

Frontend

Backend

iOS

Android

Database

Cloud & DevOps

AI / ML

Frontend

Backend

iOS

Android

Database

Cloud & DevOps

Our Effective, Efficient & Expert Practices

Partner with Tech.us and redefine your insurance services, as we enable you to better equip the cutting-edge technology with our Insurance Software development services.

Step 1

Understand

Explain your requirements, and we work alongside you. Our team understands your specific objectives and develops unique solutions.

Step 2

Cost Estimate

We follow transparent budget estimates when it comes to resource allocation for insurance software development services. We clearly inform you of the required investments.

Step 3

Plan

We chart out a clear roadmap to deliver the best insurance software solutions, and once you approve it, we will initiate our work.Deliver

Step 4

Deliver

We employ best practices and advanced technology, as our team taps into its potential to build solutions - our deliverables are precise and timely.

Awards & Recognitions

Our industry awards & recognitions stand as a proof to our excellence in scaling up businesses with our proof-tested insurance software development services.

Success Stories

We are trusted as a reliable partner in transforming our clients’ vision, as we enable them to drive better results with technology-backed software solutions.

Helping millions of people achieve ultimate financial freedom in life. Tony Robbin's 'Wealth Maestry' - An application that provides wealth management solutions & tools to achieve financial success.

Results

Customer Satisfaction

- Personalized financial plans with robust tech support

Boosted ROI

- Increase revenue through continuous support

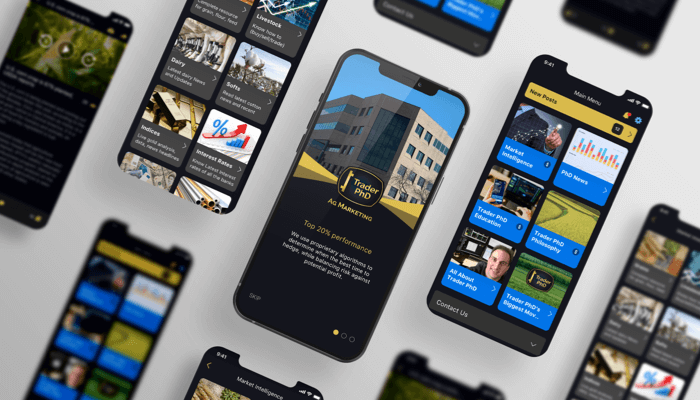

Redefining the face of agriculture and helping farmers make informed choices in the commodity market. Trader PhD’s mobile app provides real-time market data, analysis tools and expert insights to help farmers maximize their profits.

Results

+ $2 Million

- Increase Annual Revenue

Increased Monetization and Decreased Friction

- Through easy in-app purchases and targeted advertising

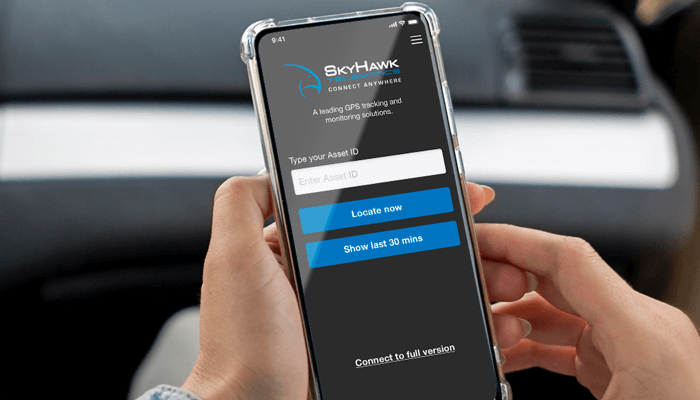

SkyHawk by Telus created a lightweight mobile version of their Connect Anywhere application which provides fleet connectivity and operational excellence. We built various features including locating assets, fleet activity, secure configurations and a lot more.

Results

Improved Digital Experience

- Enhanced experience with seamless map display

Increased Revenue

- Improved returns through better functionality

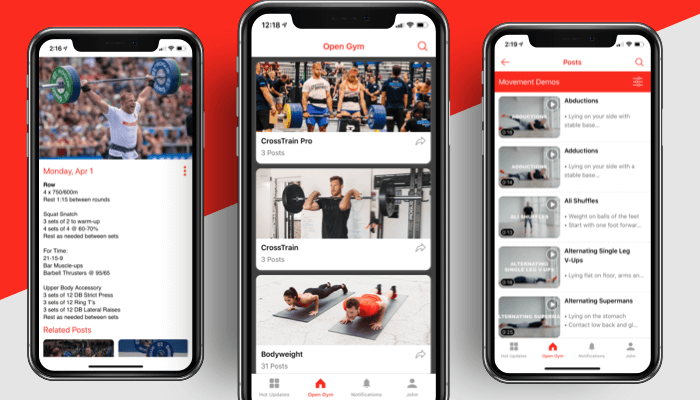

Making world-class training easy and accessible with a seamless and intuitive mobile app. Partnering with Tech.us, Open Gym created a first-of-its-kind fitness application that simplifies the fitness game and also has in-app purchase functionalities.

Results

50% Boost

- Achieved in business

Real-Time Updates

- Implemented timely information dissemination

What Are the Benefits of Insurance Software Development?

Our strategic insurance software development empowers insurers to simplify complex operations and deliver service that smoothens their internal processes and keeps policyholders loyal for years.

Faster Claims Processing and Settlement

Digital workflows reduce paperwork delays and ensure faster resolution for customers. Teams handle more claims in less time while maintaining accuracy every step of the way.

- Automated processing that speeds up decision-making

- Smooth updates for customers during the claim journey

- Lower operational burden with fewer manual touchpoints

Improved Underwriting Speed and Accuracy

Risk evaluation becomes more precise when data is verified instantly and insights are easy to act on. Smarter underwriting leads to better pricing decisions and stronger margin protection.

- Consistent decisions backed by reliable information

- Lesser time spent on evaluating each application

- Better quality control with fewer evaluation gaps

Enhanced Customer Experience

Customers interact with your business on their terms through self-service options that simplify every action. A convenient experience drives higher loyalty and stronger referrals.

- Faster responses without waiting for an agent

- Simple access to policies and service requests

- Stronger trust built through transparency

Reduced Operational Costs

Automation removes repetitive work and cuts expenses tied to large back-office operations. Every minute saved translates into better ROI and healthier margins.

- More efficient resource utilization

- Elimination of avoidable errors and rework

- Lower dependency on manual tasks

Stronger Security and Regulatory Confidence

Secure software protects sensitive data from breaches and ensures compliance with industry regulations. This safeguards brand reputation and customer trust.

- Controlled access to confidential records

- Secure information transfer and documentation

- Protection against fraud risks and data misuse

Improved Business Visibility and Decision-Making

Centralized data provides clarity into performance trends and risk patterns so leaders act faster on what matters. Better insight leads to more strategic growth.

- Real-time tracking of insurance operations

- Early risk alerts that protect profitability

- Clear insights that drive competitive strategy

Commonly Asked Questions

It is the process of creating digital tools which help insurers with the following:

- Manage policies

- Underwriting

- Claims

- Payments

- Customer interactions

Insurance software helps teams process claims with higher accuracy from start to finish. It essentially automates repetitive tasks and brings human in the loop wherever necessary.

Yes. Modern systems can connect with your current platforms which help your teams upgrade in a smart way without any interruptions.

Digital underwriting gives underwriters verified data with clear insights which help them make confident decisions faster while reducing paperwork.

Yes. Customers with insurance software can easily manage their policies with just a few taps and interact with the platform to clear doubts and track claims through self-service options on web or mobile.

Insurers can provide secure platforms and role-based access which helps keep information safe. With regular monitoring, they can prevent fraud and misuse.

Yes. As automation takes care of repetitive tasks, teams spend more time supporting customers and improving business results.

P&C, life, health, reinsurance, specialty lines, brokers and MGAs can all gain value from digital transformation.

With clear-cut analytics, businesses can get a clear picture of performance trends and risk signals, all of which help them take quick decisions that support growth.

Yes. Software gives insights into customer needs which helps insurers offer the right coverage and improve satisfaction.

Our Services

Talk to US

© 2024 Tech.usTM. All Rights Reserved.